The emerging ESCOs, or Energy Services Companies of the Future, will encourage and capitalize on the growth of Renewable Energy penetration.

Continue readingGetting ReWired – Building Below Zero: The Net Zero Plus Transformation, Part 2

Video Summary – PART 2

In this important PBS video, Building Below Zero: The Net Zero Plus Transformation, actor and environmentalist Ted Danson narrates this examination of the Net Zero Plus Transformation: buildings that produce and store more energy than they consume, lowering greenhouse gas emissions and potentially impacting global climate change.

http://www.pbs.org/video/2365855579/

Flex Lab – part of the National Renewable Energy Lab – Energy efficiency totally new integrated building that allows us to test building energy efficiency as a system.

Cindy Regnier Executive Manager Flexlabs – Major End use – lighting, envelop shading HVAC and how it relates to the grid how does the technology we use work well with the renewable production and lower costs and usage. Takes the risk out by providing independent evaluation of these large scale technologies before manufactures building owners and investors commit large amounts of money, square footage and investment programs.

Is There A Strong Business Case To Pursue Leasing Zero Energy Buildings?

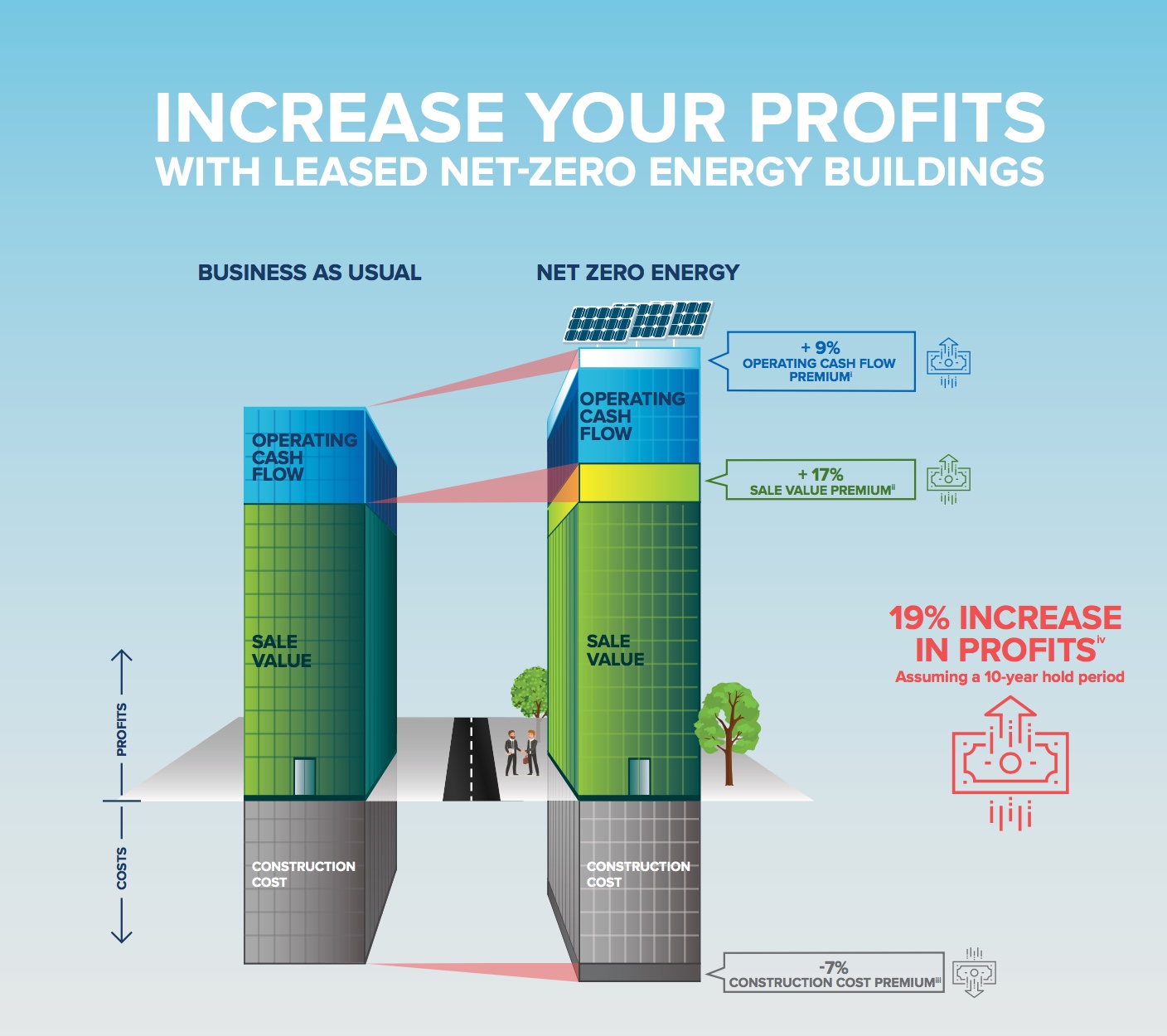

Commercial buildings in the U.S. account for over a third of the energy consumption and nearly twenty percent of carbon emissions and over half of non government owned commercial building are leased. Energy usage can be systematically reduced in leased commercial buildings in order to make great progress towards meeting our carbon reduction goals. These efforts can make good business sense for developers and landlords who are considering leasing Net-Zero buildings. In this SolarEconomist blog post I recommend The Rocky Mountain Institute’s recently published actionable guide explaining the business case and process for developers and landlords to pursue Net-Zero Energy leased buildings.

HIGHLIGHTS OF THE GUIDE

1. NZE buildings can provide strong returns to developers and landlords 3 to 5 percent higher occupancy rates , 3.5 percent higher rental rates and 13 percent higher sales prices.

- Assuming an investment of 10 percent additional construction costs, (not including solar costs), an developer or landlord could have an 8 year payback through higher operating income.

- If a building is owned for 10 years and then sold, the owner could receive 19 percent higher profits than a comparable non-NZE building.

- A developer that immediately sells the building upon project completion could receive 17 percent higher profits than a non-NZE building.

2. To achieve NZE, four critical components must be included in the lease process and structure:

- Energy budget: is the amount of energy allocated to each occupant based on using less than the renewable energy generation capacity of the building. Maintaining the energy budget requires landlord tracking and occupant agreement as well as appropriate incentives.

- Submetering and disclosure: participants can only manage what is measured, so there needs to be a basic level of sub metering between occupants and common areas. The energy use data needs to be made visible and shared with the occupants on an ongoing basis.

- Recommissioning: include a requirement for recommissioning in the lease as an operating expense ensuring the building continues to operate as efficiently as possible.

- Cost recovery: leases should have language that allows the costs and benefits for solar PV and efficiency upgrades to flow back to the proper party or parties.

3. NZE leases are possible and profitable for both new construction and existing buildings. Since existing buildings typically have existing tenants and leases, the landlord and tenant need to work together to get the pathway to NZE through the following steps:

- Step 1: Gather past energy data on the building and share it with the tenants.

- Step 2: Set aggressive yet achievable energy goals with tenants.

- Step 3: Recommission the building so it is operating as efficiently as possible.

- Step 4: Implement energy efficiency and solar PV upgrades using financing mechanisms that can be passed through to the tenant such as a solar power purchase agreement (PPA) or commercial property assessed clean energy (PACE) financing.

4. Landlords and tenants alike can take action today with ready-to-deploy resources and the model lease provisions provided along with RMI’s guide.

IS THERE A STRONG BUSINESS CASE FOR NZE-LEASED BUILDINGS?

The answer is…yes, as the RMI guide states:

Solar can be viewed as a separate income-generating investment or could be third-party financed via PACE or PPAs, effectively removing the upfront premium. Other barriers preventing market penetration of NZE buildings are perceived technical barriers, lack of awareness, fear of trying something new, and increased attention from the developer and design team. An increasing number of examples show the market is learning how to build NZE buildings effectively, leaving leasing and other business model components as the next frontier to tackle to scale this market. This guide covers the multiple benefits that provide an attractive return on investment to a developer:

- TENANT ATTRACTION

- LOWER VACANCY RATES AND IMPROVED

- TENANT RETENTION

- HIGHER RENT

- FUTURE-PROOFING INVESTMENT

- ADDITIONAL BENEFITS FOR FIRST MOVERS

-Warren Evans, @theSolarEconomist

ABOUT THE ROCKY MOUNTAIN INSTITUTE – Since 1982, The Rocky Mountain Institute (RMI) has been engaged with businesses, communities, institutions, and entrepreneurs to accelerate the adoption of market-based solutions that cost effectively shift from fossil fuels to efficiency and renewables.

The Energy Gang Takes On Trump’s Solar Tariffs

The Trump Administration just imposed 30 percent tariffs on imported solar cells and modules. How much will it stunt solar growth in America? Will it spark a broader trade war? There’s a lot of questions about the impact, in this podcast The Energy Gang Covers:

- What does a 30 percent tariff mean for project economics in the residential and utility-scale sectors?

- How will the 2.5-gigawatt cell quota work?

- Will the decision help domestic U.S. manufacturing? Will it hurt domestic installation jobs?

- What kind of challenges will we see at the World Trade Organization?

- Is there a pathway toward negotiation with China?

- How could local policy blunt the negative impact of these tariffs?

Summary: The US International Trade Commission ruled this fall that domestic solar manufacturers had faced serious injury from imported solar cells and modules. After review of that case the Trump administration largely followed the tariff recommendations of commissioners, on Monday January 22nd the Office of the US Trade Representative issued 30% Tariffs on cells and modules coming from outside the US. Those tariffs step down 5% each year over the next 4 years, the tariff took effect on February 7th. Here is Corey Honeyman’s (Associate Director of GTM Research’s Solar Practice) take:

- Not the Worst Case: The 30% tariff equates to about 10 cents/watt tariff stepping down to about 4 cents a watt in year 4. This is not a worst case scenario however, GTM forecasts ~10% reduction in demand which they predict may slow solar job growth by 20K positions.

- Utility Scale Solar is Sensitive: utility scale solar will be the most sensitive segment to the introduction of tariffs. GTM’s expectation is that 7.6 GWs of lost demand from their base case forecast over the next 5 years. ~65% of that lost demand is expected to come from the Utility Scale solar segment because with every additional 10 cents/watt increase to system pricing equates to an additional 0.25 to 0.35 cents/kWh to competitive PPA pricing for Utility scale solar.

- Emerging Markets Pushed Back: this additional pricing hurts competitiveness within new build natural gas and displacement of coal fleets retiring early. 10 cents/watt is enough of a difference to emerging markets for example the south east; Florida, Georgia and South Carolina. Residential solar is expected to be more resilient, except for again, those emerging markets where parity is close, these tariff levels will ultimately push back the economic attractiveness for solar in these areas.

- 2.5 GW Cell Quota: 2.5 GWs of cells won’t be subject to the tariffs. In any given year the US will be able to import up to 2.5 GWs of cells without paying any tariffs. This will benefit existing US based module assembly manufacturers such as Tesla/Panasonic in Buffalo and Solarworld who won’t pay the tariffs if they can import under that limit.

There have been price increases over the past 6 months in advance of the announcement of tariffs, this has pushed module pricing over 40 cents/watt, here are two factors that can mute the downturn effects in 2018:

- Advance Procurement: developer and suppliers have been scooping up a lot of product in advance of these tariffs. This has created some buffer through the 1st half of 2018 since somewhere around 2 GWs of tariff free panels have been procured by these activities especially related to Utility Scale solar.

- Domestic Manufacturers: are a source for tariff free solar modules. For example, 1st Solar with it’s thin film supply, and other domestic manufacturers like Suniva and SolarWord (residential segment) won’t pay these penalties.

Read the briefing and listen to The Energy Gang podcast here:

Joel Rhodes from Forbes Magazine has some good ideas on how to minimize the impact of this tariff in his article:

Trump’s Solar Tariffs Go Into Effect Today. So What?

https://www.forbes.com/sites/joshuarhodes/2018/02/07/trump-solar-panel-tariff/#5cb116de376d