Commercial buildings in the U.S. account for over a third of the energy consumption and nearly twenty percent of carbon emissions and over half of non government owned commercial building are leased. Energy usage can be systematically reduced in leased commercial buildings in order to make great progress towards meeting our carbon reduction goals. These efforts can make good business sense for developers and landlords who are considering leasing Net-Zero buildings. In this SolarEconomist blog post I recommend The Rocky Mountain Institute’s recently published actionable guide explaining the business case and process for developers and landlords to pursue Net-Zero Energy leased buildings.

HIGHLIGHTS OF THE GUIDE

1. NZE buildings can provide strong returns to developers and landlords 3 to 5 percent higher occupancy rates , 3.5 percent higher rental rates and 13 percent higher sales prices.

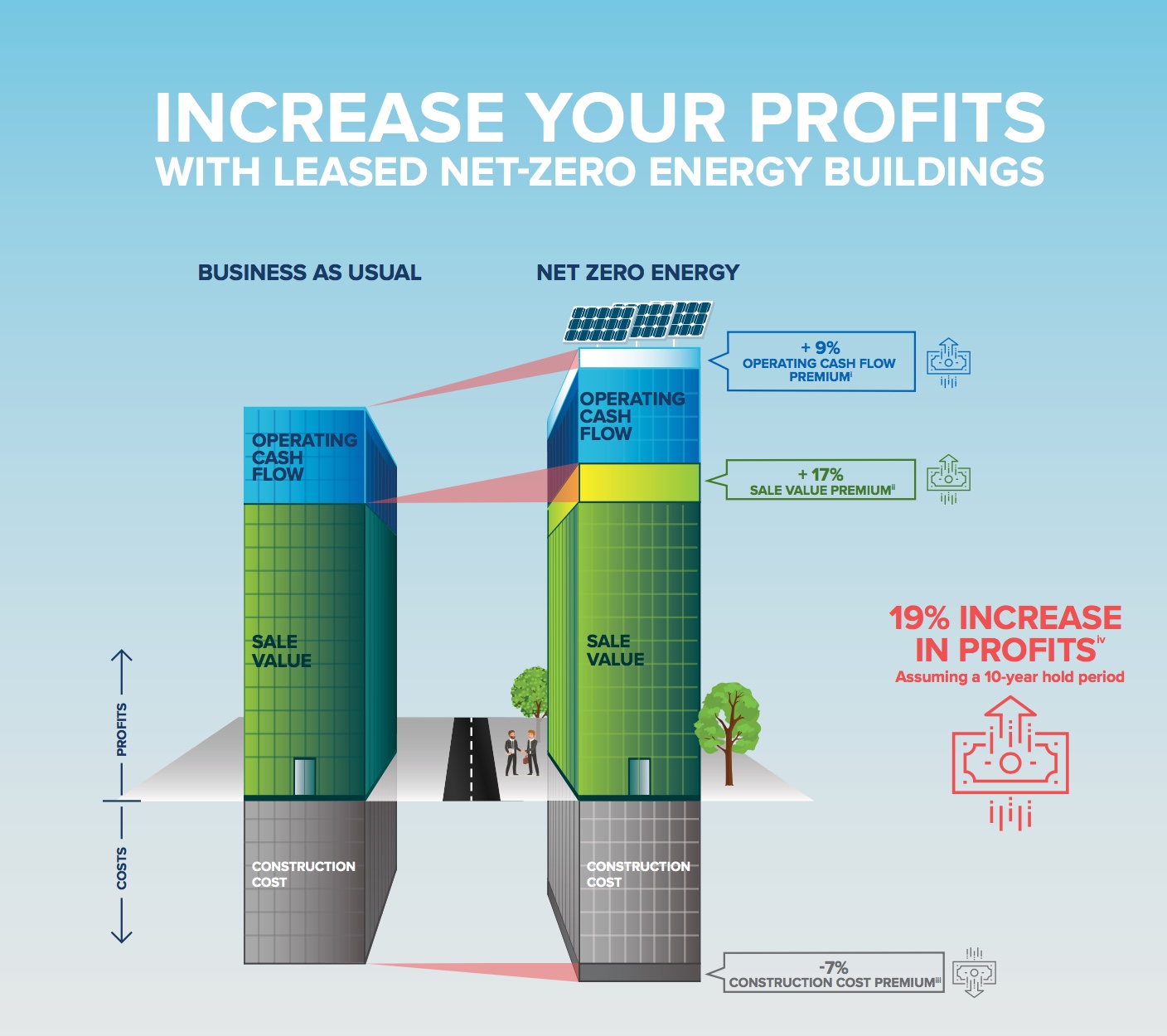

- Assuming an investment of 10 percent additional construction costs, (not including solar costs), an developer or landlord could have an 8 year payback through higher operating income.

- If a building is owned for 10 years and then sold, the owner could receive 19 percent higher profits than a comparable non-NZE building.

- A developer that immediately sells the building upon project completion could receive 17 percent higher profits than a non-NZE building.

2. To achieve NZE, four critical components must be included in the lease process and structure:

- Energy budget: is the amount of energy allocated to each occupant based on using less than the renewable energy generation capacity of the building. Maintaining the energy budget requires landlord tracking and occupant agreement as well as appropriate incentives.

- Submetering and disclosure: participants can only manage what is measured, so there needs to be a basic level of sub metering between occupants and common areas. The energy use data needs to be made visible and shared with the occupants on an ongoing basis.

- Recommissioning: include a requirement for recommissioning in the lease as an operating expense ensuring the building continues to operate as efficiently as possible.

- Cost recovery: leases should have language that allows the costs and benefits for solar PV and efficiency upgrades to flow back to the proper party or parties.

3. NZE leases are possible and profitable for both new construction and existing buildings. Since existing buildings typically have existing tenants and leases, the landlord and tenant need to work together to get the pathway to NZE through the following steps:

- Step 1: Gather past energy data on the building and share it with the tenants.

- Step 2: Set aggressive yet achievable energy goals with tenants.

- Step 3: Recommission the building so it is operating as efficiently as possible.

- Step 4: Implement energy efficiency and solar PV upgrades using financing mechanisms that can be passed through to the tenant such as a solar power purchase agreement (PPA) or commercial property assessed clean energy (PACE) financing.

4. Landlords and tenants alike can take action today with ready-to-deploy resources and the model lease provisions provided along with RMI’s guide.

IS THERE A STRONG BUSINESS CASE FOR NZE-LEASED BUILDINGS?

The answer is…yes, as the RMI guide states:

Solar can be viewed as a separate income-generating investment or could be third-party financed via PACE or PPAs, effectively removing the upfront premium. Other barriers preventing market penetration of NZE buildings are perceived technical barriers, lack of awareness, fear of trying something new, and increased attention from the developer and design team. An increasing number of examples show the market is learning how to build NZE buildings effectively, leaving leasing and other business model components as the next frontier to tackle to scale this market. This guide covers the multiple benefits that provide an attractive return on investment to a developer:

- TENANT ATTRACTION

- LOWER VACANCY RATES AND IMPROVED

- TENANT RETENTION

- HIGHER RENT

- FUTURE-PROOFING INVESTMENT

- ADDITIONAL BENEFITS FOR FIRST MOVERS

-Warren Evans, @theSolarEconomist

ABOUT THE ROCKY MOUNTAIN INSTITUTE – Since 1982, The Rocky Mountain Institute (RMI) has been engaged with businesses, communities, institutions, and entrepreneurs to accelerate the adoption of market-based solutions that cost effectively shift from fossil fuels to efficiency and renewables.